Banking

More data for the data driven

Clearly I am not a stock analyst. But I am also very bothered when I can’t get good data. Yeh, I am a data guy at heart. When I go to the news aggregators and can’t find up-to-date information on bank stocks, valuations, closures - in the middle of a crisis, I get annoyed. And then I look for data.

My “go to” is the Yahoo Finance page, which has a great search engine - Just put in a corporate name and it spits out the current stock valuation, percent price change and a nice graph. Wiki lists the 100 largest banks in the USA. From there, I began entering names into the Yahoo Finance page.

The list at Wiki of the largest 100 banks is here.

This is just more data for the data driven.

My little search around Yahoo Finance soon revealed that Wall street seems to be doing an extremely efficient job of sorting viable from non-viable banks.

The majority of banks are holding value - with stock prices being negatively affected by less than 5%. This is good news.

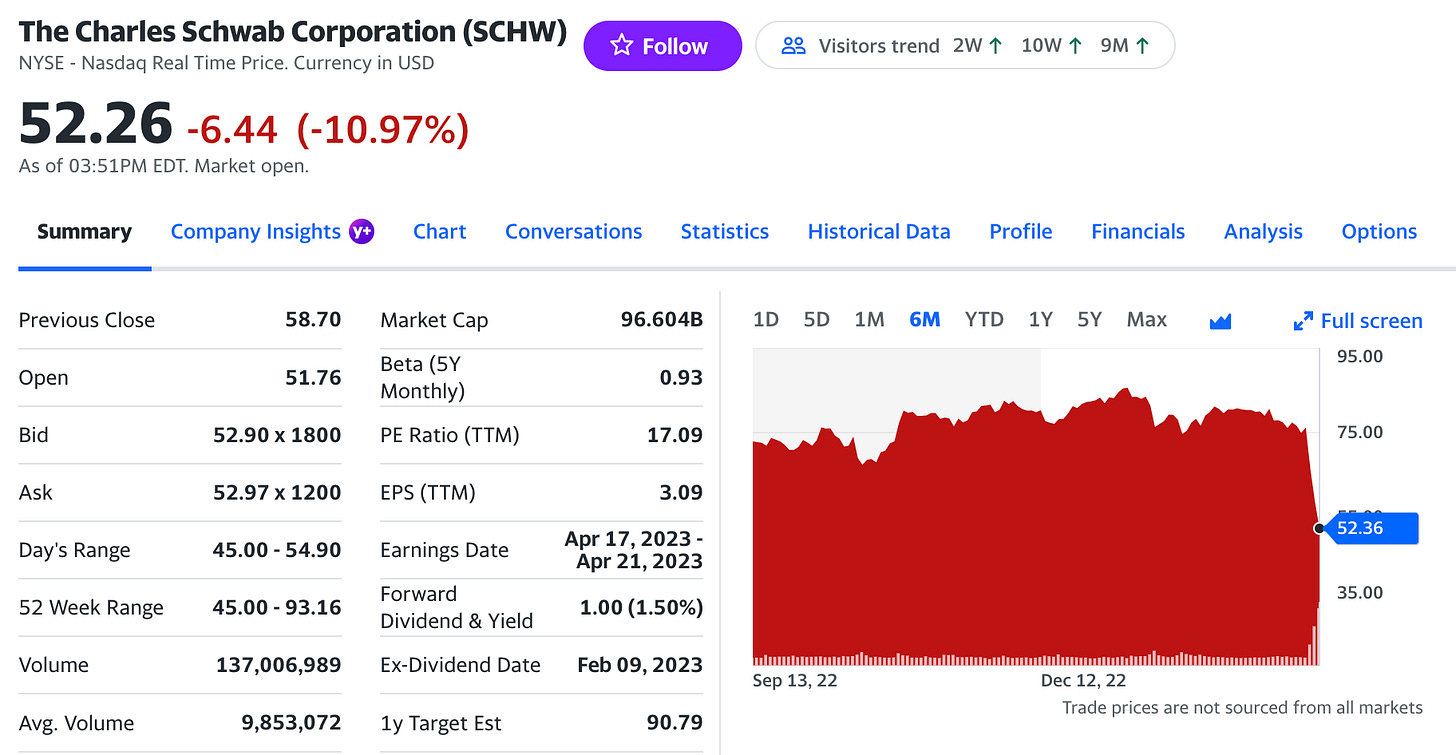

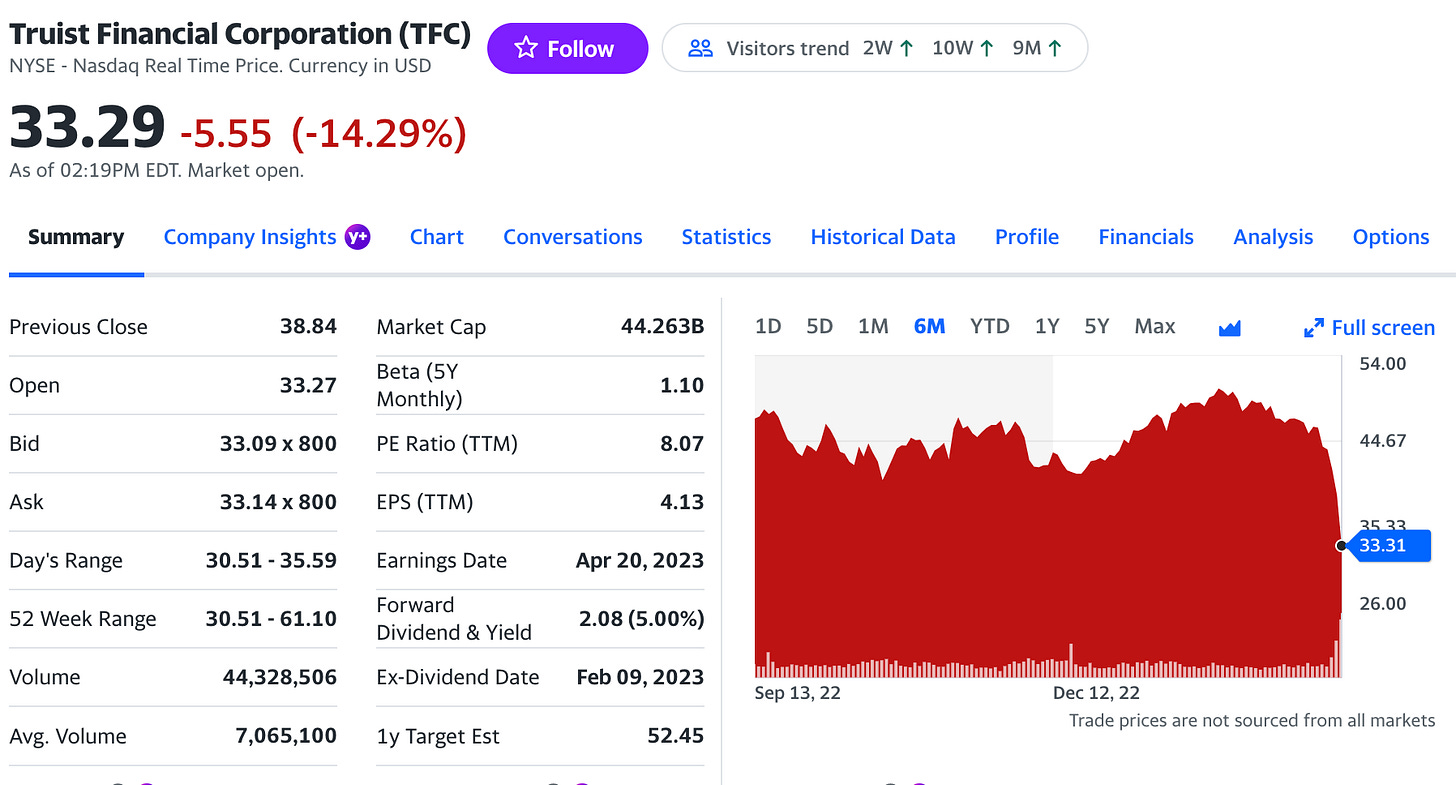

These are the ten largest banks in the USA - most are not losing stock value of any real significance. Charles Schwab and Truist being the two outliers (see the charts below).

Investors are generally savvy. I am sure that as soon as the news hit about Silicon Valley Bank, everyone went scurrying to the various bank’s 2022 annual reports and 4th quarter balance sheets. Many of the smaller and regional banks appear to be in trouble.

Here are the graphs from Charles Schwab and Truist. The percent in parenthesis is the stock value price change for the day at the time of the image capture. I set the X axis on all graphs to six months.

The 11% loss of value of the Charles Schwab corp worrying because this is where so many people stash their retirement monies. But the holding company is making many assurances that they are actually ok. Another article lists the reasons why Schwab’s stocks are being affected here.

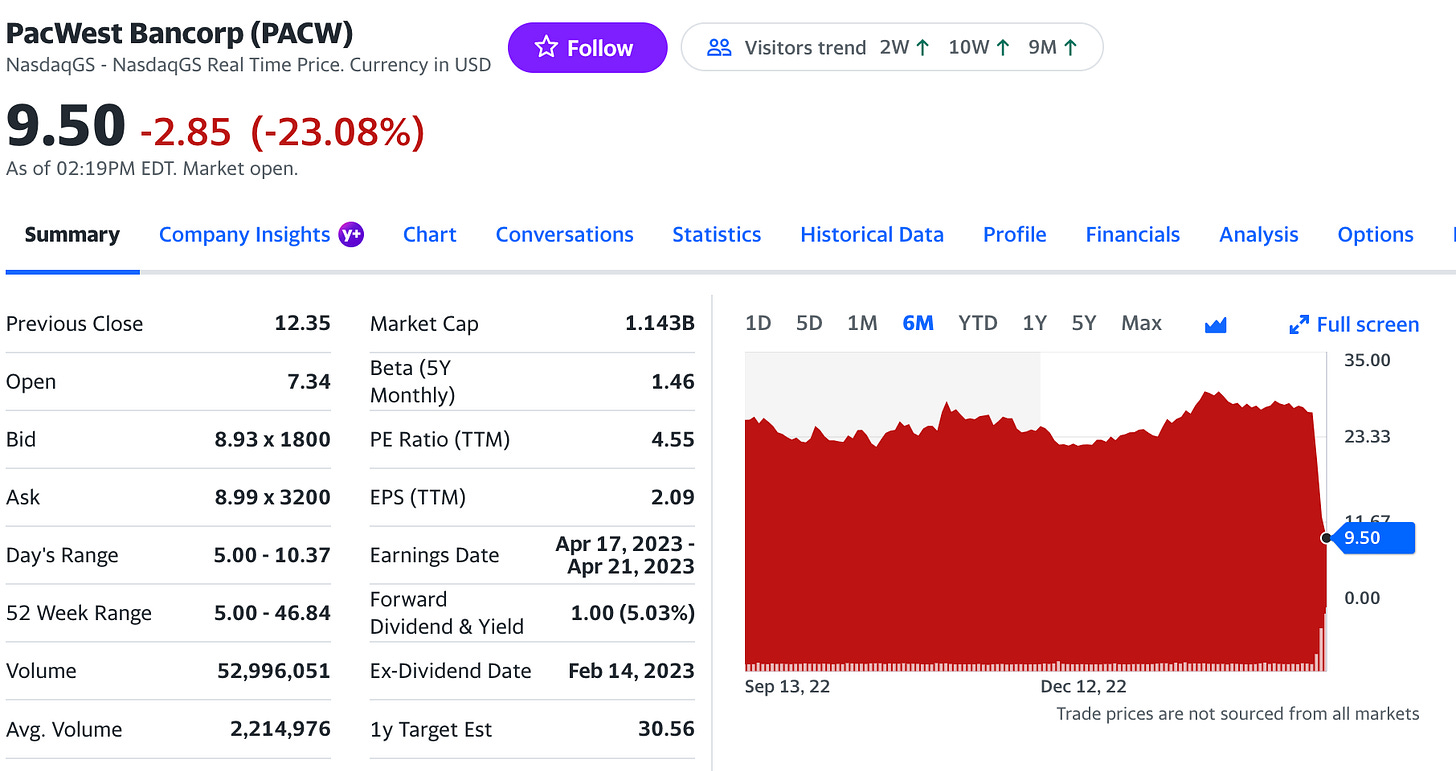

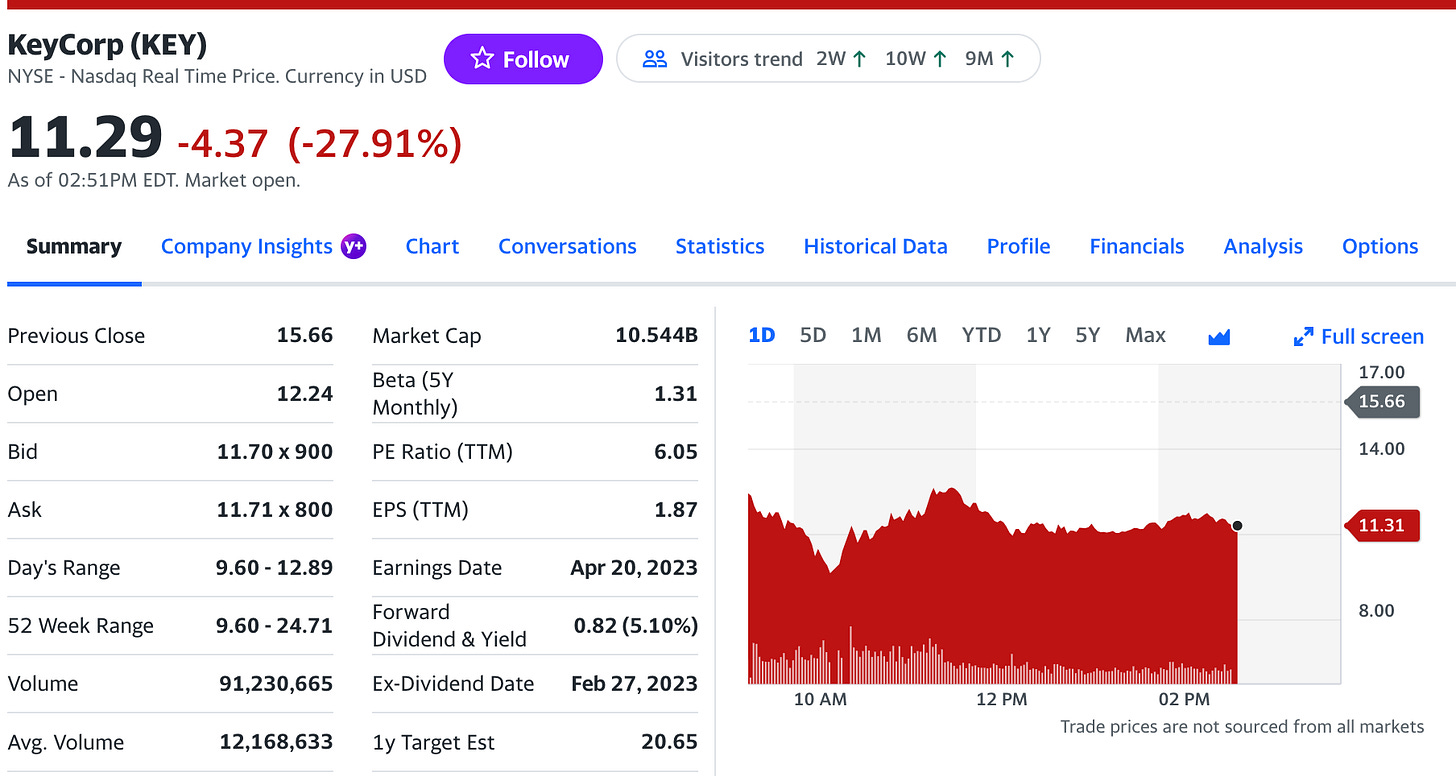

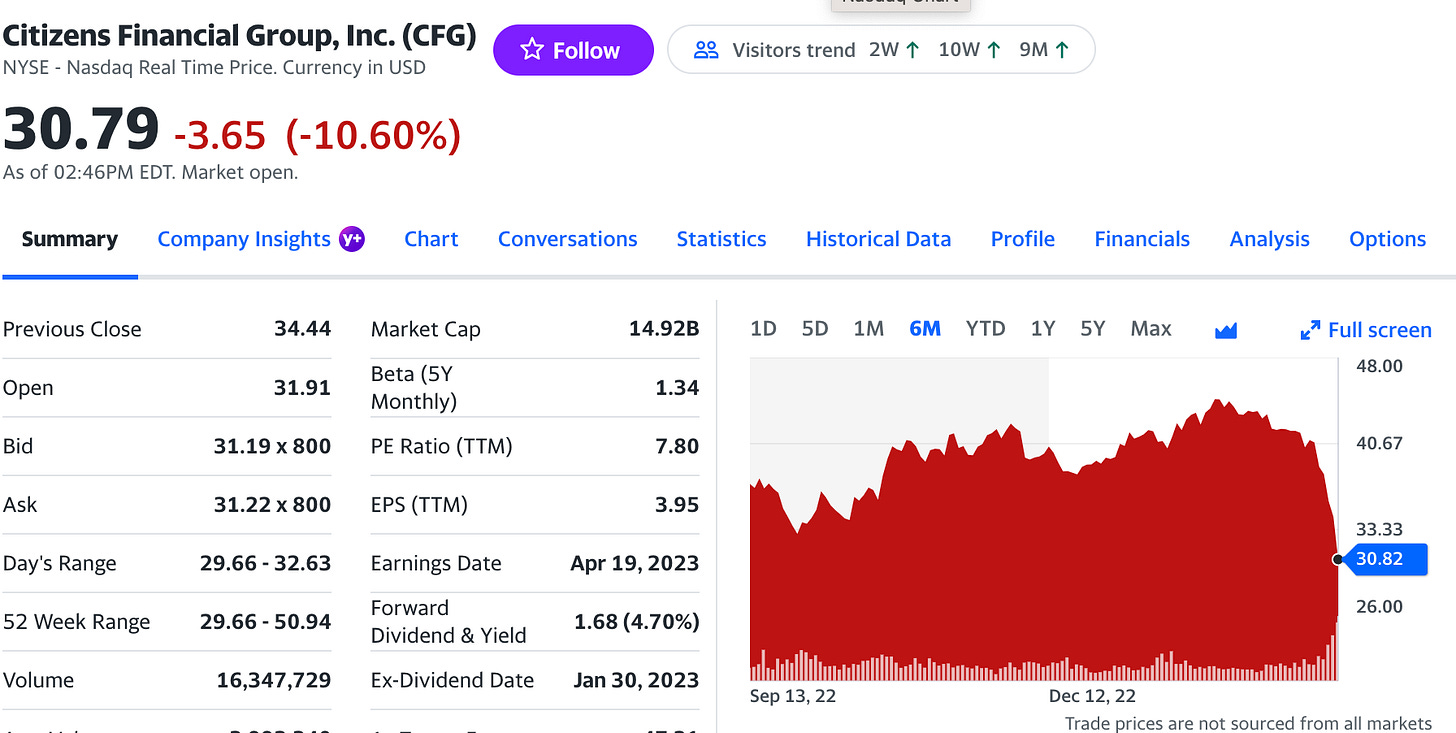

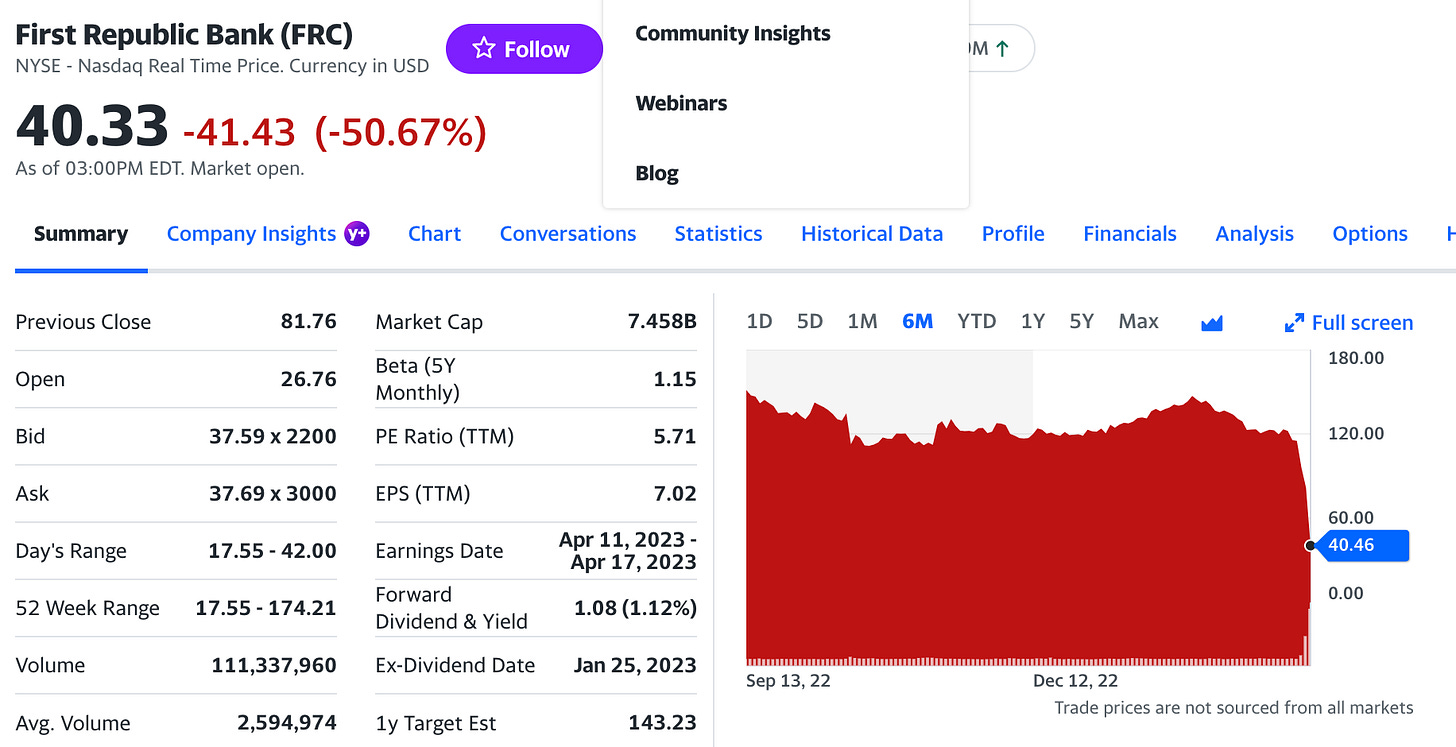

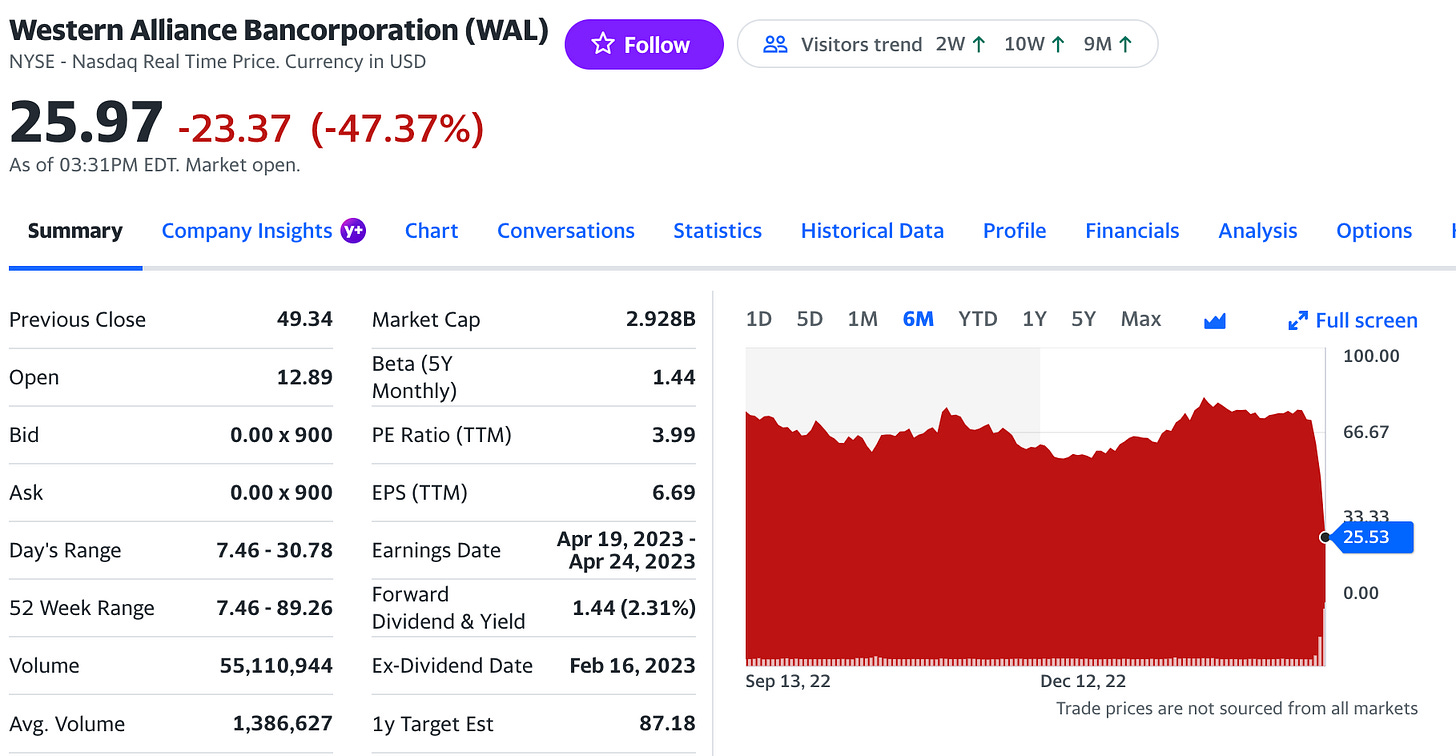

Some of the smaller banks lost a lot of stock value today.

Stock analysts appear to reacting to what they are finding on a closer inspection of the balance sheets.

Also note, that this is just the daily change in stock valuation. Some of these charts show a sharp decline in valuation over the past week. Trading was very volatile in the banking sector today.

The worst hit from this crisis are as follows (this may not be a complete list) - obviously SVB has stopped trading, so it is not here.

One interesting thing about the banking system, is that many of the smaller banks (the lower 50% of the top 100 banks in the USA list) are privately held. So, if they are on the verge of folding, there is literally no way to know.

As I said, I am not a stock analyst- take all of this with a grain of salt. But I do like data and I have a nose for detail. I hope this helps someone make a bit more sense out of this mess!

These are not the final stock prices for the day, but a snapshot of when I captured the image

It just strikes me the outcome of this is similar to what the lockdowns did - to - the small businesses and - for - Amazon, Walmart, etc.. Consolidation. The 2008 bailouts of the too big to fail banks created SIBs (Systemically Important Banks) and guess what? Seems like the SIBs are doing just fine (at least for the moment). Just like in 2008, their investments and balance sheets don't matter.

But, after people flee the "risky" banks and into the "safe" SIBs, it seems to me like that will be the perfect point to launch central banks/ CBDCs. Next step, orchestrate a dollar crisis. Centralization and CBDCs as the answer. Why not throw in vaccine passport/IDs as well. Who will be able to resist?

Personally, I'd rather see states rise up with their own sovereign banks, decentralize the heck out of the financial system and get back to having some banks that are set up for savings and payrolls and not permitted to go off dabbling in derivatives, etc. If we had state sovereign banks right now, I would bet quite a few would be fleeing for those rather than Citigroup or Bank of America. Is anyone in Congress even looking into this???

Not sure where to put this, but VERY important links: Tom Renz suggested amendments for various upcoming state CBDC bills that are made to look like they don't have anything to do with CBDCs.

https://tomrenz.substack.com/p/the-tyrants-are-passing-state-laws and a notice from the Fed about their upcoming FedNow instant payments system coming in July. Sounds like Digital ID will be required. https://www.federalreserve.gov/newsevents/pressreleases/other20230315a.htm

It's all coming together fast now.